Even though loss-making, Ather must be doing something right. As established rival Ola Electric juggles heavy losses and a tanking market share, the recently listed EV maker improved its overall margins in Q1 FY26 by slashing its losses by 26% sequentially. So, what drove Ather’s run during the quarter?

Inside Ather’s Glovebox: Ather brought down the cost of goods sold 25% to INR 1.12 Lakh in Q1 FY26 from INR 1.48 Lakh in FY24, helped by a decline in the prices of battery cells and other cost-cutting measures.

A healthy revenue contribution from its non-vehicle business (accessories, software, and services) further helped the company bring down losses. However, an industry-wide slow Q1 dented its sales, which fell 3% sequentially.

Ather’s Diversification Card: Ather has been able to engineer its way to better gross margins by building value-driven products. The launch of the budget-friendly Rizta scooter helped Ather expand market reach, acquire scale, build brand recall and address traditional EV adoption barriers like range anxiety and family utility.

While Ola Electric maintained higher sales volumes through aggressive pricing and broader distribution, Ather’s approach remained more measured (more premium mix, ecosystem monetisation through its SaaS services and cost control), which helped its revenue jump 79% YoY.

What’s Next? Over the next few quarters, while Ather will be seen doubling down on its R&D push and product innovation to achieve long-term EBITDA gains, Ola Electric could consider leveraging its cost reduction efforts and in-house battery production to improve margins.

With a strategy focussed on “middle-India” and sustainable growth, can Ather zoom past Ola Electric? Let’s find out…

From The Editor’s DeskClear Axes 100 Jobs: The tax filing platform has laid off about 16% of its total workforce amid its AI push and a “broader strategic organisational restructuring”. The Peak XV-backed startup last laid off nearly 200 employees during a retrenchment exercise in September 2022.

Antfin To Exit Eternal: The affiliate company of Alibaba Group is set to sell 18.8 Cr shares of foodtech major in a block deal worth around INR 5,375 Cr. This comes close on the heels of Antfin dumping its entire stake in fintech major Paytm.

The Sleep Company Nets INR 480 Cr: The D2C mattress brand has raised the funding in its Series D round from ChrysCapital and 360 ONE Asset. The Sleep Company sells mattresses, recliner beds, pillows, seat cushions, office chairs, and other bedding accessories.

LEAD School’s FY25 Show: The edtech startup managed to reduce its standalone net loss by 69.7% to INR 43.3 Cr in FY25 from INR 143 Cr in FY24. Meanwhile, LEAD School’s operating revenue remained flat at INR 351.8 Cr during the fiscal under review.

Zype Nets INR 90 Cr: The fintech startup has raised the capital in a mix of equity and debt from Unleash Capital Partners, Xponentia and others. Zype operates as a credit-first financial well-being and lifestyle app, which helps users get instant loans.

Early Backers Dump Ola Electric Stakes: Z47 and Tiger Global Management pared down their holdings in the EV giant in Q1 FY26. While the former dumped 0.81% stake for INR 144 Cr, the latter diluted 0.21% shareholding in the company for INR 36.6 Cr

Livspace Picks Up Stake In TPlusA: The IPO-bound home decor startup has acquired an undisclosed stake in the early-stage furniture manufacturing startup. TPlusA India manufactures furniture hardware and accessories.

SuperGaming Nets $15 Mn: The gaming studio has raised the capital in its Series B round, co-led by Skycatcher and Steadview Capital, at a valuation of $100 Mn. The startup is building mobile games such as MaskGun, Silly Royale and others.

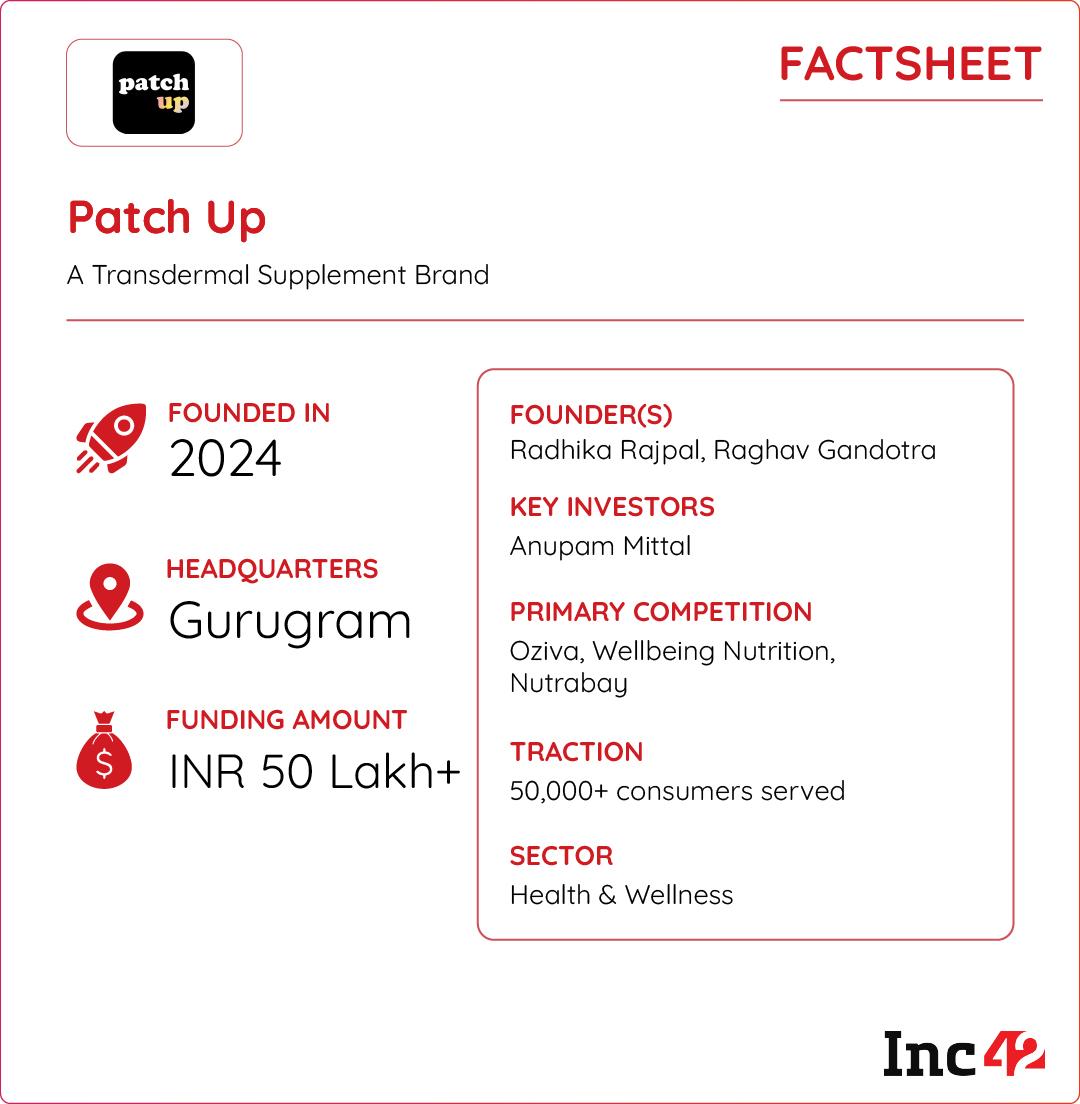

Inc42 Startup Spotlight Can This Startup Patch Up India’s Nutritional Gaps?India faces widespread nutritional deficiencies due to poor dietary habits and low awareness. These gaps impact energy, immunity, and long-term health, often without people realising.

The New Quick Fix: Founded just last year, Patch Up Health offers clean, transdermal nutrition patches as an alternative to pills and powders. Their additive-free, sugar-free patches deliver vitamins through the skin — bypassing gut issues and enhancing absorption. With five SKUs, each patch targets specific wellness goals like sleep, skin, or energy.

The Opportunity Ahead: India’s dietary supplements market is projected to cross INR 5,5770 Cr by 2033, with consumers becoming more conscious post-pandemic. Patch Up’s innovation stands out in a category that lacks true differentiation. Patch Up is backed by a strong founding team, medical experts, and early traction — including a Shark Tank deal and INR 4.2 Cr revenue in its first year.

Challenges Remain: As the market crowds, sustaining consumer interest and retention will be key. While transdermal delivery is disruptive today, competition can catch up, making brand trust and ongoing innovation crucial for Patch Up’s long-term play.

With rivals like OZiva, HealthKart and Nutrabay on its tail, can Patch Up fix India’s supplement needs with its novel approach?

The post Is Ather Reving Enough, Clear Axes 100 Jobs & More appeared first on Inc42 Media.

You may also like

BJP leaders writes to ECI, claims constitutional violations by Mamata Banerjee

Heartbreaking last photo of Oasis fan partying at Wembley before falling to his death

New World War 2 film's incredible true story of sacrificial rescue is now streaming

Piers Morgan told to 'have a day off' after accusing Beyoncé of 'cultural appropriation'

Spaghetti bolognese will be 'sweet and creamy' if you add 1 unusual ingredient