India’s enthusiasm for AI is evident. From the government to enterprises and academia, everyone is eager to showcase their vision for AI adoption. Yet, despite all the buzz and optimism, investors remain cautious, and funding remains a concern.

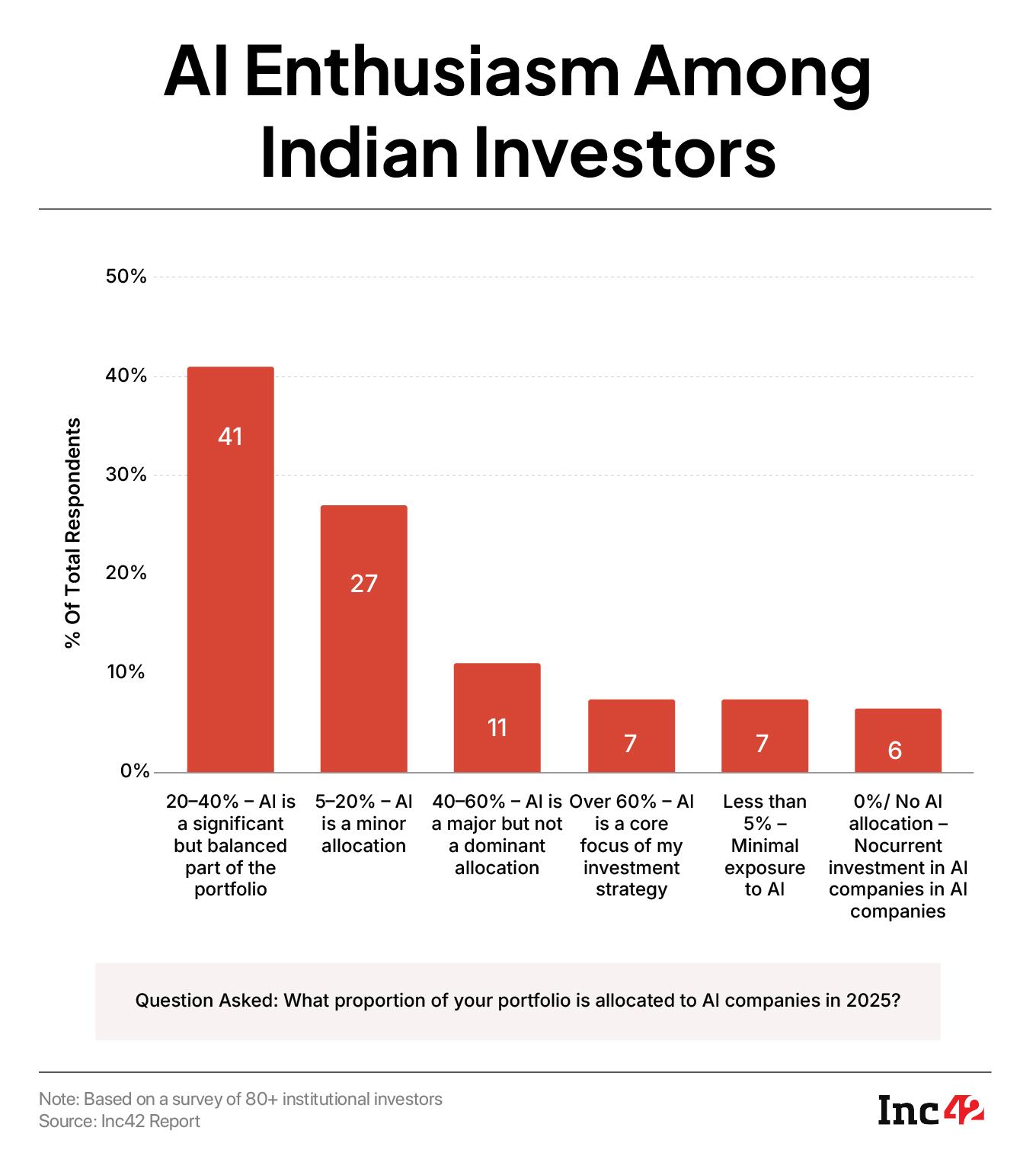

A recent survey of more than 80 institutional investors conducted by Inc42 revealed that while 41% of Indian investors are allocating 20–40% of their portfolios to AI, only 7% are making it a core investment focus. Coincidentally, the share of investors with the least exposure to AI investments is also 7%.

The survey further revealed that for 27% of investors, AI comprised a mere 5–20% of their total funding, and 6% of the investors still don’t have any stake in AI companies.

At a time when India is urging the development of open-source systems and the creation of “quality data centres” free from biases, why is there a dearth of trust among investors? Before we ponder, let’s take a quick look at India’s AI funding scenario.

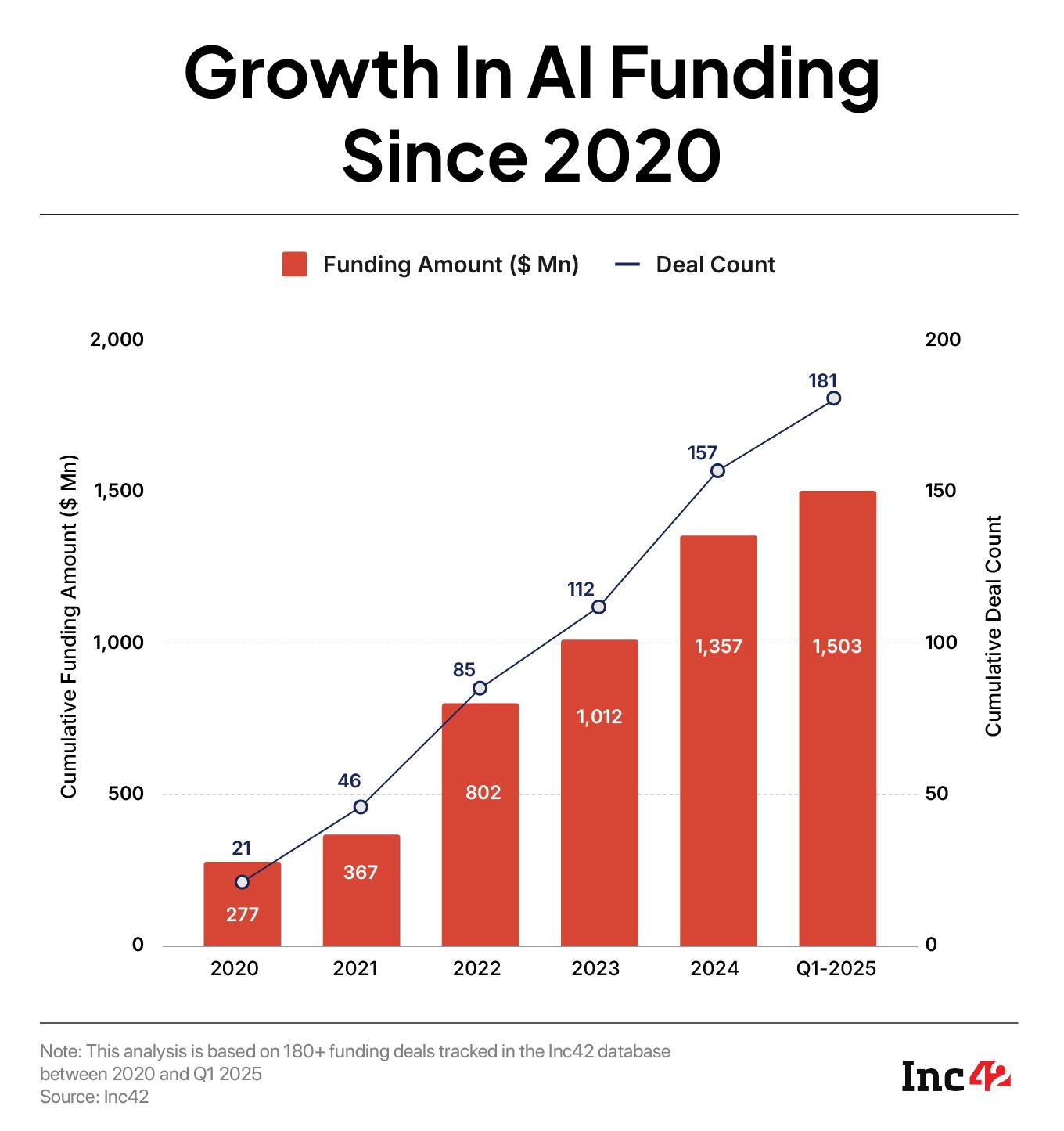

AI Deals Rise, But Funding Still LagsTotal AI investments in the country jumped 69% between 2022 and 2024. In 2023, new investments to the tune of $210 Mn were lapped up. This number increased to $245 Mn by last year.

Until Q3 of 2025, more than $260 Mn has already been infused in native AI startups. Deal counts have also increased over the years.

While there is growth in funding, AI is still among the least funded sectors in India. For context: AI startups could raise a mere $120 Mn in Q3 2025. In comparison, ecommerce, healthtech and enterprise Tech, the most funded sectors of the just-concluded quarter, secured $356 Mn, $300 Mn and $285 Mn, respectively.

Deal count, however, did not disappoint. The number of AI deals stood at 26 during the quarter, sharing the podium with ecommerce and advanced hardware & technology at 56 and 29 deals, respectively.

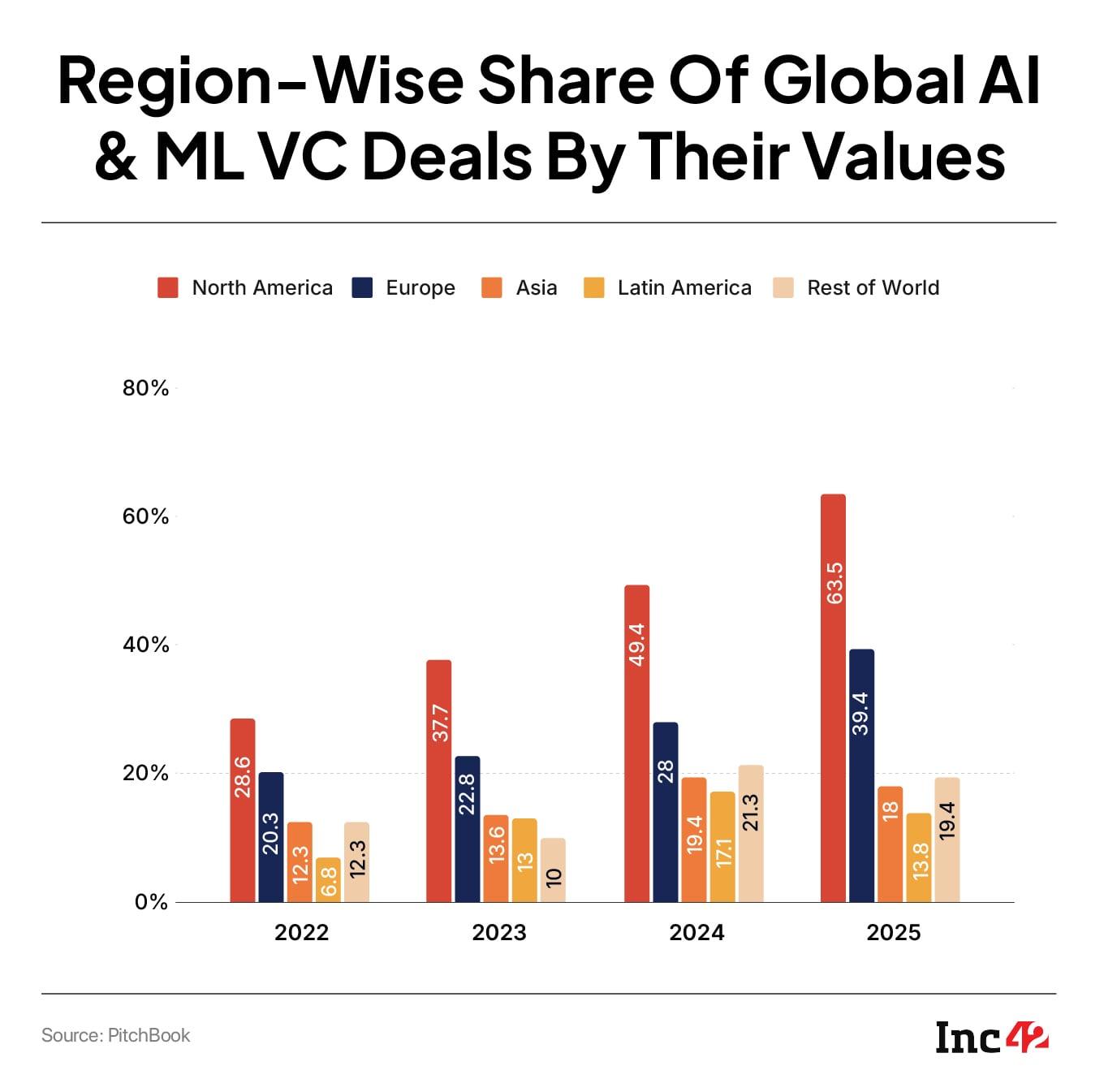

In contrast, global VC investments in AI reached $193 Bn by Q3, highlighting India’s smaller share in the global AI investment landscape.

US-based Anthropic raised $13 Bn in its Series F round last month, OpenAI secured $40 Bn in March, and several smaller US AI startups raised between $100–200 Mn each. In comparison, the largest AI round raised in India this year was $25 Mn, raised by Chennai-based SuperOps.

“India’s startup sector often operates in the middle of two worlds. On the one hand, our levels of innovation are hugely admirable, but on the other, there lies the issue of an enabling ecosystem that is yet to mature,” said Girish Shivani, the executive director and fund manager at YourNest VC.

According to him, mega AI rounds happen in the US more because of the track record of producing globally successful tech companies and the abundance of capital and large corporate markets that can quickly adopt these platforms.

On the other hand, he said, the Indian ecosystem is still focussed on applied AI, which addresses sectoral issues in manufacturing, logistics, healthcare, and BFSI.

“Additionally, the cost and accessibility of compute infrastructure are higher here, and late-stage investment capital pools are lower. Therefore, it is unlikely that India will be able to match the amount of capital being deployed internationally in the near future.”

Responding to our survey findings, Shivani said that more than practising caution, VCs are weighing their options to fund the crème de la crème of the AI companies.

But What’s Souring India’s AI Growth Story?Our findings show that several factors are constraining AI startup funding in India. While the initial wave of excitement centred around AI application builders, investors have grown cautious after several shutdowns and raise doubts over how much “AI” some of these “.AI” startups actually offer. VCs are hesitant to back yet another AI wrapper with limited depth.

While there is no shortage of innovation, the challenge lies in paving the way for scalable innovation and long-term use cases.

Ace investor Shashank Randev, however, does not see any delay or a lack of investment in AI. “There is enough VC dry powder for AI-focussed investments. The problem, however, is assessing the quality of startups, good business use cases in verticalised AI models.”

Randev emphasised that startups are actively seeking funding for various AI-enabled models – be it for use in semiconductors or GPUs, or quantum computing hardware – but investors will have to develop in-house research capabilities to evaluate these startups.

YourNest’s Shivani noted that AI valuations are currently inflated due to market hype. “We are seeing great founders in India, but beyond this, we are looking for companies that have a clear route to profitability, confirmed client demand, and proprietary intellectual property,” she said.

Randev pointed out that foundational players like Sarvam AI securing funding signals real momentum in the ecosystem.

Another challenge behind cautious funding in the Indian AI realm is that many domestic funds remain sector-agnostic and traditionally oriented toward faster-scaling opportunities such as D2C.

For these investors, an AI startup – with longer gestation and higher risk – often loses out to a more predictable bet.

However, the counter to this is the rise of tech-focussed funds in India. “The rise of tech-focused funds in India shows growing appetite for AI-enabled models — whether in middleware, foundational AI, or cybersecurity,” Randev said.

As these use cases mature, one must remember that India’s AI journey is still in its early days, and the technology landscape is evolving faster than funding cycles can adapt.

Overall, Indian VCs do not seem unwilling to fund AI startups, nor are AI investments in the country set to go down. However, a note of caution remains.

“The risk is that we back startups today, but we don’t know if they will still be relevant in a year or two,” said Alok Goyal, the partner at sector-agnostic VC Stellaris.

On the other hand, the onus is also on startup founders to build tech and business models that can stand the test of time.

[Edited By Shishir Parashar]

The post India’s AI Funding Paradox: Investors Show Caution But Deal Activity Sees Momentum appeared first on Inc42 Media.

You may also like

Saaraa Khan on marrying Krish Pathak: 'Two hearts, two cultures, one forever'

World Bank's BETI project empowering micro-level women in India to build businesses

BREAKING: Dolly Parton's furious response after sister asks for prayers

Can Ad-hoc committee suspend a person during inquiry of sexual harassment?: asks Delhi HC

Poll code applicable to Central govt too for policy decisions on Bihar: EC